A few weeks ago, the International Federation of the Phonographic Industry announced that the Japanese music industry saw a decline of .9% in 2019. The Recording Industry Association of Japan recently released its year-end report for 2019, going into more detail about the state of the industry over the course of last year.

Together, the physical and digital markets had a value of 299.8 billion yen at the end of 2019, a decrease of 2% compared to 2018.

In 2019, the revenue of the physical market, which includes CDs, vinyl, DVDs, and Blu-rays, decreased by 5% to 229.1 billion yen. This decline comes after three consecutive years of growth. Last year also saw a 7% decline in the number of units produced compared to the previous year, totalling 180.67 million units.

On the other hand, the revenue of the digital market, which is composed of downloads and streaming, increased by 10% compared to 2018, totalling 70.6 billion yen. This was the sixth consecutive year of growth, and the second consecutive year of double digit growth. It also marks the first time that the digital market has cracked 70 billion yen.

In regard to music audio discs, the number of units produced fell by 4% compared to 2018 to 134.3 million units, while revenue from this segment decreased 3% to 152.8 billion yen. The number of CD albums produced remained virtually unchanged at 88.69 million units, while their revenue fell by 1% to 113.3 billion yen. In terms of CD singles, the number produced declined by 11% to 43.36 million, while their revenue fell by 8% to 36.2 billion yen. The vinyl market saw its sixth consecutive year of growth in 2019. This segment saw an increase in the number of units produced of 9% to 1.22 million units, while revenue grew by 3% to 2.1 billion yen.

In terms of music video discs, the number of units produced decreased by 16% compared to the previous year to 46.37 million, while shrank grew by 8% to 76.4 billion yen. The number of DVDs produced declined by 24% to 31.59 million units, while revenue dropped by 15% to 39.2 billion yen. In regards to Blu-rays, the unit production grew by 6% to 14.79 million units, while revenue increased by 1% to 37.1 billion yen. This was second consecutive year of growth for both the unit production and revenue of Blu-rays.

Based on revenue, the physical market is 66.7% audio discs and 33.3% video discs.

When it comes to the digital market, downloads fell by 12% in 2019 compared to the previous year to 94.29 million downloads. Download revenue also fell by 12%, to 22.5 billion yen. On the other hand, streaming grew by 33% for the second year in a row, to 46.5 billion yen. Based on revenue, the digital market is 66% streaming and 32% downloads. The remaining 2% of the digital market is comprised of ringback tones (1.7%), master ringtones (.3%), and miscellaneous (.3%).

In terms of total revenue, the Japanese market is 76.4% physical and 23.6% digital.

There were 11,149 newly released physical recordings last year. This is the sixth year of decline, with the last year of increase being 2013’s 17,013. The number of newly released physical recordings in 2019 is the lowest its been since 1970.

Pop / kayokyoku is the most popular genre for newly released domestic physical recordings in 2019, comprising 66.7% of the market. It is followed by enka (13.4%), anime (9.6%), screen (2.6%), kids (1.9%), light music (1.7%), classical (1.1%), traditional (1%), and miscellaneous (1.9%).

Rock / pop / dance is the most popular genre for newly released international physical recordings last year, making up 37.4% of the market. It is followed by classical (34.2%), jazz / fusion (16.3%), additional genre (6.6%), screen (5.2%), and miscellaneous (.4%).

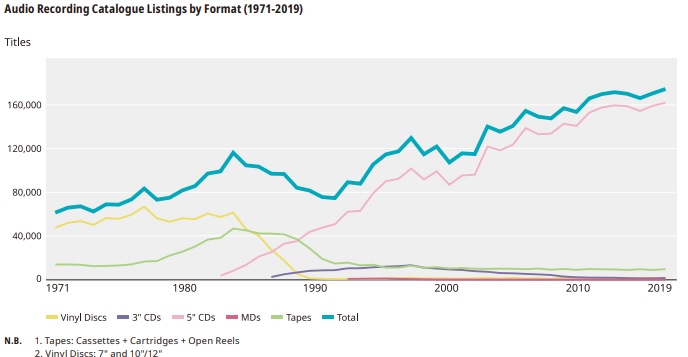

There were a record 174,617 catalog (old and new music combined) listings last year.

Pop / kayokyoku is the most popular genre for catalog listings in 2019, comprising 56.1% of the market. It is followed by enka (16.4%), anime (9%), traditional (3.7%), classical (3.6%), light music (3.3%), kids (2.7%), screen (1.3%), karaoke (.1%), and miscellaneous (3.9%).

Classical is the most popular genre for catalog listings last year, making up 46.7% of the market. It is followed by rock / pop / dance (33.4%), jazz / fusion (10.8%), additional genre (6.1%), screen (1.9%), and miscellaneous (1.2%).

There were 363 debuts last year, made up of 268 first debuts and 95 second debuts.

There were 1,844 record rental shops in 2019. This is the same number that existed in 1983. Record rental shops have been in decline since their peak in 1989 at 6,213.